What Is Missing in Your Risk Analysis?

1. Find

the lowest Risk trade from a group of potential stock picks.

2. Determine

the Risk versus the Gain Profit Potential BEFORE placing an order.

3. Determining

the correct Stop Loss placement to avoid setting the Stop at a whipsaw point,

or not using a Stop at all due to not knowing how to use and set them

correctly.

4. Selecting

the strongest picks based on Risk Analysis, which reveals weaknesses in stock

picks that do not show up in Candlestick Patterns or MACD patterns.

5. Choosing

stocks with Risk that you can tolerate. Too many times traders get greedy, and

choose picks that have higher Risk than they are ready to accept.

TechniTrader

"The Gold Standard in Stock Market Education"

Go to the TechniTrader

Trading

the automated markets along with Market Participant Groups that use Time

Weighted Average Price orders, Volume Weighted Average Price orders,

and High Frequency Trading predatory millisecond orders requires using

MODERN analysis and tools. It is hard to abandon techniques learned on the

internet that appear everywhere but in order to be successful, Traders need to

change how they approach trading.

When

choosing a stock to trade among a group of stock picks, consider the Risk of

the trade based on technical Support levels appropriate for your Trading Style.

Trading Styles include Intraday Swing, Swing Trading, Momentum Trading, Position

Trading, and several others.

Go to the TechniTrader Basics of the Stock Market for New Investors and Beginning Traders Webinar Lessons, to experience for yourself the excellence of TechniTrader education.

Go to

TechniTrader

Webinar Lessons

Strategies

are selected AFTER a Trading Style has been chosen. Certain Trading Styles

require specific technical patterns, candlesticks, and Support levels for

optimal trading success. Buying long versus Selling Short also changes Support

and Resistance levels for each Trading Style.

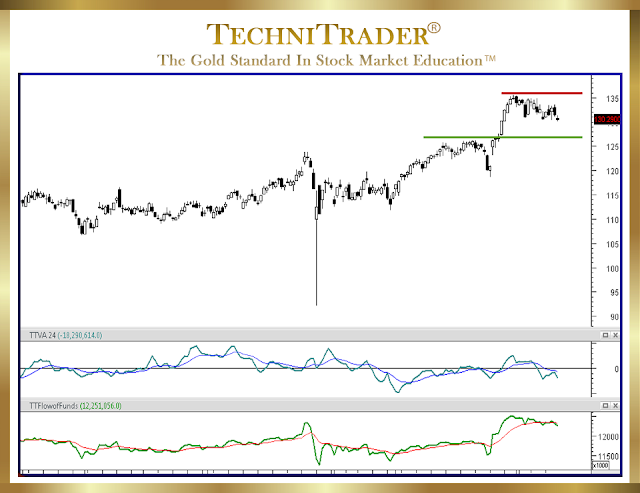

As

an example for Risk Analysis see stock chart below, which has an Engulfing

Black candlestick Sell Short signal.

The

next area of calculation must be the Support, which is where the stock is

likely to bounce up as indicated by the green line. This is the highs of

November, and may not hold over time but is the first level of Support for this

stock if it sells down further. Support therefore is based not on a Percentage

but the technical levels where bounces occur from Buy to Cover Professionals

closing their position, OR from “Buy on the Dip” Small Lot Investors rushing to

buy into what they believe is a bargain.

Go to the TechniTrader How to Trade the Stock Market Webinar for Beginners, to experience for yourself the excellence of TechniTrader education.

Go to

the TechniTrader

Summary

By

calculating the difference between the Resistance and the Entry Price, the Risk

of the trade is determined. By calculating the Support level where the stock is

mostly likely to pause or bounce, the run Gain Profit Potential is determined.

The final step is dividing the points at Risk by the points Gain Potential.

Risk to Profit should be 3/1 or higher.

Most

of the time Retail Traders are trading stocks with higher points at Risk than

there are potential points to Gain. Taking the time to calculate Risk using

Risk Analysis will significantly improve your profitability by eliminating high

risk and low profit trades.

TechniTrader

"The Gold Standard in Stock Market Education"

Go to the TechniTrader

Followers

may request a specific blog article topic by emailing info@technitrader.com

Trade

Wisely,

Martha

Stokes CMT

TechniTrader technical analysis using a MetaStock chart, courtesy of Innovative Market Analysis, LLC dba MetaStock

Chartered Market Technician

Instructor & Developer of TechniTrader Stock and Option Courses

TechniTrader DVDs with every course.

This weekly stock discussion is sponsored by TechniTrader.com a MetaStock® Partner

©2016–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.