Calculate the Cost of Trading When Determining Profits

How to use

Dark Pool Candlestick Patterns Patterns for higher profits, is an area of

Technical Analysis that has not made its way into most stock market books,

articles, and information available on the internet. The reason why Dark Pool

technical patterns aka footprints are not yet part of the Technical Analysis

standard of teaching, is that these are NEW chart candlestick patterns.

Dark Pools

did not exist in the 1980’s, 1990’s, or early 2000’s decades. These are

relatively new trading venues for the giant Buy Side Institutions who demanded

obscurity, due to the rise of the High Frequency Trading Firms in the mid 2000

decade after the switch from fractions to decimals. Basically High Frequency

Trading Firms morphed out of the Small Order Execution System Bandits, during

the rouge Floor Traders era.

Calculate the Cost of Trading When Determining Profits

How to use Dark Pool Candlestick Patterns Patterns for higher profits, is an area of Technical Analysis that has not made its way into most stock market books, articles, and information available on the internet. The reason why Dark Pool technical patterns aka footprints are not yet part of the Technical Analysis standard of teaching, is that these are NEW chart candlestick patterns.Dark Pools did not exist in the 1980’s, 1990’s, or early 2000’s decades. These are relatively new trading venues for the giant Buy Side Institutions who demanded obscurity, due to the rise of the High Frequency Trading Firms in the mid 2000 decade after the switch from fractions to decimals. Basically High Frequency Trading Firms morphed out of the Small Order Execution System Bandits, during the rouge Floor Traders era.

Go watch How to Trade the Stock Market Webinar

Go to the TechniTrader

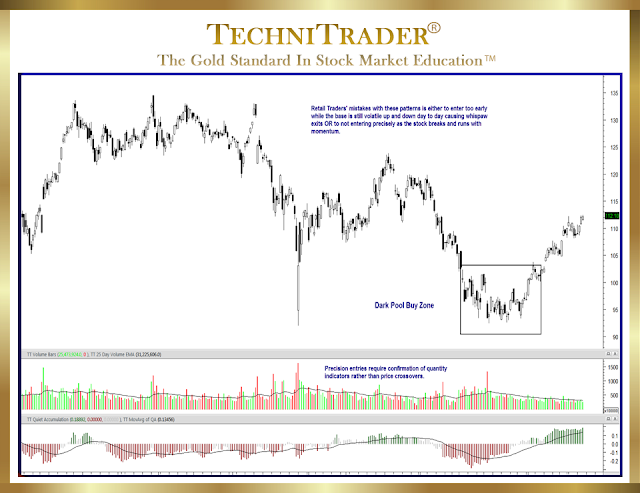

Nearly all large and giant lots are transacted nowadays on the hidden Alternative Trading System venues called Dark Pools, which are used by giant Buy Side Institutions. However what can not be hidden, is their easy to identify candlestick footprints on stock charts.

There

are many different types of Dark Pool footprints that the giant Institutions

leave on charts, due to their preferred professional order types.

One

of the more common candlestick footprints happening is the “Basing Bottom

Formation,” which is a brand new type of bottom. In order to use

Dark Pool Candlestick Patterns for higher profits, the key element in this

pattern is to identify the Dark Pool Quiet Accumulation and enter early before

the stock runs up.

See a chart example below of a Basing Bottom Formation caused by giant Buy Side Institutions orders using Dark Pools.

However, early entry can be problematic if a trader is using Price and Time Indicators, as well as both Momentum and Price Oscillators. You may get an early crossover, but then the stock moves sideways up and down in a choppy pattern which causes whipsaw exits and losses.

Another

problem getting in early is that many Retail Traders wait and wait for signals

from Momentum Indicators, which gets them into the stock very late in the run.

This means instead of a high profit trade, the Retail Trader takes a meager

profit. The Retail Traders Market Participant Group includes those who have

learned to trade from home.

Go watch the Basics of the Stock Market for New Investors and Beginning Traders 12 Webinar Lessons.

Go to the

TechniTrader

12 Webinar Lessons

To

accurately calculate whether a trade is profitable or not, you must also

include ALL of the normal business expenses for Trading as a Business.

Trading

as a Business includes the following:

1.

You MUST pay yourself something for your time. How much could you make an hour,

working for a corporation in your field of expertise or your degree? That is

the minimum amount you should use as a base for trading expense as an hourly

wage.

2.

You must also include the average losses. You must take an average of your

losses each month and divide it into your trades per month, and subtract that

loss from your profits of every profitable trade.

3.

Other expenses include your computer, printer, and other hardware

depreciation.

4.

In addition there is the office space in your home, electricity, internet,

phone, and office expenses such as paper, pens, and journals.

5.

Finally add up the cost of time attending webinars, the reading articles, and

also if you pay a paper trading simulator fee.

Summary

If

you did an accurate calculation of your true trading costs, you would find that

taking a .25 cent profit on a 100-1000 share trade is not at all profitable.

You are actuality losing money every time you trade. So learning how to enter a

stock trade earlier based on recognizing a Dark Pool Buy Zone™ is crucial, and

can turn your trading into a career.

Go to the Learning Center and watch a wide variety of training webinars.

Go to the

TechniTrader

TechniTrader

The Gold Standard in Stock Market Education

The Gold Standard in Stock Market Education

Trade Wisely,

Martha

Stokes CMT

TechniTrader technical analysis using a MetaStock chart, courtesy of Innovative Market Analysis, LLC dba MetaStock

Chartered Market Technician

Instructor & Developer of TechniTrader Stock and Option Courses

TechniTrader DVDs with every course.

This weekly stock discussion is sponsored by TechniTrader.com a MetaStock® Partner

©2016–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.

Disclaimer: All statements are the opinions of TechniTrader, its instructors and/or employees, and are not to be construed as anything more than an opinion. TechniTrader is not a broker or an investment advisor; it is strictly an educational service. There is risk in trading financial assets and derivatives. Due diligence is required for any investment. It should not be assumed that the methods or techniques presented cannot result in losses. Examples presented are for educational purposes only.