Trading Range Market Conditions

Trading Range Market

Conditions are rather rare. They do not occur on the long term trend often.

This is the most challenging market condition for Technical and Retail Traders.

It is a challenge because it seems as if the market is chaotic, volatile, or

random in nature.

Often times traders

do not recognize Trading Range Market Conditions, because they either do not

know about this condition or they do not use charts that show what is really

happening.

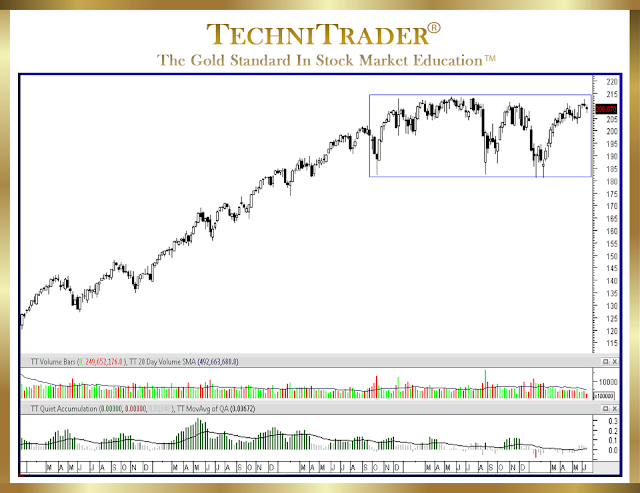

The chart example

below is a Weekly Chart view, and clearly shows the Range Bound pattern.

The chart example has

nearly consistent highs as if there is a Technical Resistance above price, and

inconsistent lows. Many traders are assuming this is a Bear Market, but it is

not.

Trading Range Market

Conditions occur for several reasons. This one in particular has specific

reasons WHY the big blue chip stocks are stuck in sideways patterns.

Here are the reasons

why big blue chip stocks are sideways:

1.

The price of stocks over the prior 4 years was artificially inflated, as many

big blue chip companies decided to do massive buyback stock purchases. This

removed a huge amount of liquidity of the company stock. Since stock prices are

based upon supply and demand as much as fundamentals, the draw down of

liquidity forced prices upward, as the corporations intended. However, buybacks

are a temporary event and do not last. As the buybacks ended, stocks began to

show signs of weakness in the chart patterns as far back as the middle of 2014.

2.

Fundamentals and Financials which had a huge growth out of the 2009 economic

contraction, started to slow down in 2014 at the commencement of the Trading Range.

Dark Pools who control vast quantities of stocks, started Quiet Rotation to

lower their held shares of stock in companies poised for a business

contraction. This fueled many Topping Formations late in the year 2014 and

early 2015.

This Trading Range

Market Condition was predicated, on obvious and easily seen patterns in

the charts. By understanding what was going on with stocks beyond just a mere

MACD Crossover or an Engulfing White Candle, Technical Traders who were able to

analyze the conditions were prepared for this Trading Range.

Summary

What happens next?

Trading Range Market Conditions rarely last a long time. Range bound

action is usually, but not always a continuation pattern. To determine whether

this is a continuation or reversal, it is necessary to study a longer term time

frame, thereby eliminating the “white noise” present in Daily or even Weekly

View charts.

Next week this

discussion lesson will analyze the longer term chart, to see whether this

Trading Range is a continuation pattern or a reversal pattern.

Followers may request

a specific article topic for this blog by emailing: info@technitrader.com

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a MetaStock chart, courtesy of Innovative Market Analysis, LLC dba MetaStock

Chartered Market Technician

Instructor & Developer of TechniTrader Stock and Option Courses

TechniTrader DVDs with every course.

This weekly stock discussion is sponsored by TechniTrader.com a MetaStock® Partner

©2016–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.

Disclaimer: All statements are the opinions of TechniTrader, its instructors and/or employees, and are not to be construed as anything more than an opinion. TechniTrader is not a broker or an investment advisor; it is strictly an educational service. There is risk in trading financial assets and derivatives. Due diligence is required for any investment. It should not be assumed that the methods or techniques presented cannot result in losses. Examples presented are for educational purposes only.