How to Create and Use Center Line Price Oscillators

Most traders are very

familiar with the standard Price Oscillators which have a high and low range.

These Price Oscillators are common and found in nearly every charting program.

There are Stochastic, Williams R, Wilder’s Relative Strength Index and many

more oscillators created specifically for determining “Overbought” or “Oversold”

conditions.

Stochastic however

was written in the 1950’s which was an entirely different market than we have

today. Nowadays Technical Traders find that Stochastic tends to give a false

negative or a false positive signal, just as the stock is beginning a Momentum

or Velocity run up with exponential point gain potential. This often frustrates

traders who are still using only the older theory of Overbought/Oversold Trend

Conditions.

Today with High

Frequency Trading Firms HFTs trading stocks in massive order flow on the

millisecond scale, Price often appears “Overbought” with the standard Price

Oscillators when it is just starting a big run. Often times Overbought Patterns

shift to the “Floating Oscillation” Pattern which is a failed signal, due to

extreme momentum energy that was not present in the trading environment when

these indicators were written.

Using Price

Oscillators Enhanced for the Modern Market is a method that TechniTrader

teaches exclusively. TechniTrader shows how to create a CENTER LINE Oscillator

very similar to Volume Center Line Oscillators. Using Volume and Price

Oscillators together can be a huge benefit in entering stocks earlier out of

Bottoms and Tops, which are often flat or basing these days rather than Triple

Bottoms or other older style Bottoming or Topping patterns you may have

been taught.

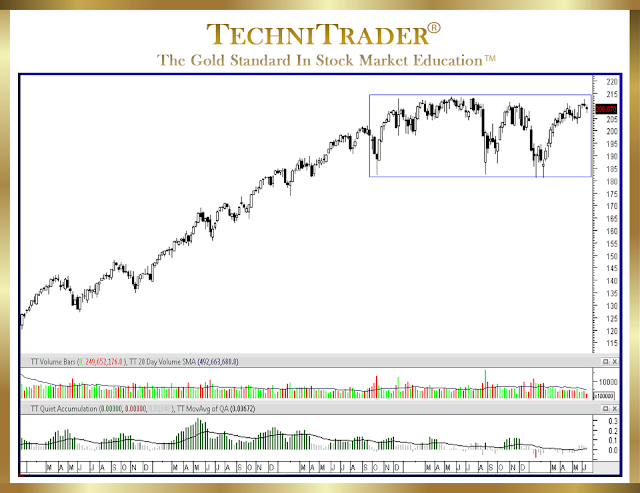

Adding a relational

center line that trends with the Price Oscillator can reveal patterns in

advance of sudden big moves. See the chart example below.

Wilder’s RSI with its

one line for oscillation is the most adaptable and easiest patterns to learn,

when incorporating this kind of Center Line Oscillation into your indicator

tool set. It was written in the 1970’s and is unique for a Price Oscillator.

Instead of just calculating Overbought/ Oversold, its formula analyzes current

price action to prior price action similar to what many Volume Oscillators

track. This helps reveal Dark Pool activity which tends to precede the sudden

runs and gaps caused by HFTs. This makes it an invaluable indicator to use for

Short Term Trading.

The Floating Center

Line has a softer Oscillation, which provides pivotal signals in the Price

Patterns. This Hybrid Indicator can be applied to many other Price and Volume

based Indicators as well. This Price Oscillator Enhanced for the Modern Market

provides a more three dimensional and Relational Analysis™ that is needed

for the more complex Market Structure of today.

Oscillators can be

far more valuable and useful when adaptations and adjustments are made to the

older indicators. This gives the Technical Trader more indicator signals, more

analysis scope, and further breadth of understanding of Price action. The more

a Technical Trader UNDERSTANDS price behavior, the better trading decisions

they can make.

Using both Center

Line Price Oscillators and Volume Oscillators, enhances and improves the

overall indicator analysis for all Trading Styles. Each Trading Style will

require modifications to the settings and periods for each Indicator.

The RSI/RSI Indicator

is part of the TechniTrader Indicator Tool Set provided to Students with

instructions on how to use it with all the Variables, Combination Indicators,

Indicator Settings, and Periods. It is one of the most versatile of all the

price indicators, and is a Price Oscillator Enhanced for the Modern

Market.

Not yet TechniTrader

Students can use this theory to design their own Indicators. The ideal

Oscillators have one Oscillation Line rather than two.

Followers may request

a specific blog article topic by emailing info@technitrader.com

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a MetaStock chart, courtesy of Innovative Market Analysis, LLC dba MetaStock

Chartered Market Technician

Instructor & Developer of TechniTrader Stock and Option Courses

TechniTrader DVDs with every course.

This weekly stock discussion is sponsored by TechniTrader.com a MetaStock® Partner

©2016–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.

Disclaimer: All statements are the opinions of TechniTrader, its instructors and/or employees, and are not to be construed as anything more than an opinion. TechniTrader is not a broker or an investment advisor; it is strictly an educational service. There is risk in trading financial assets and derivatives. Due diligence is required for any investment. It should not be assumed that the methods or techniques presented cannot result in losses. Examples presented are for educational purposes only.